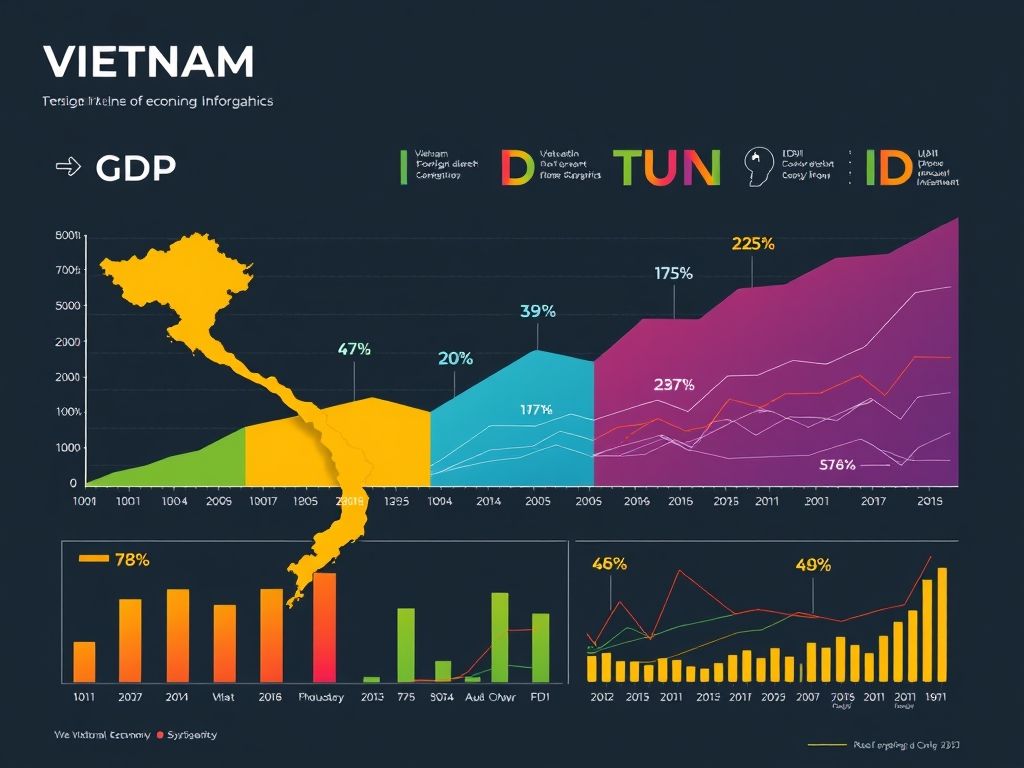

Vietnam’s economy is experiencing significant growth, attracting substantial foreign direct investment (FDI). This article delves into the key factors driving this progress, examining the country’s GDP performance and the role of FDI in shaping its economic landscape. Understanding these elements is crucial for investors and businesses seeking opportunities in the region.

Vietnam’s Economic Landscape

Vietnam’s economic landscape is a dynamic tapestry woven from a rich history of agricultural roots, a period of centrally planned economics, and a decisive shift towards a market-oriented system. This chapter provides a comprehensive overview of the nation’s economic structure, highlighting key sectors, strengths, and challenges. Understanding this landscape is crucial for appreciating the nation’s remarkable growth and its potential for continued development.

Historically, Vietnam’s economy was largely agrarian. Agriculture remains a significant contributor, employing a substantial portion of the population. However, the *economic transformation* over the past few decades has seen a rapid expansion of the industrial and service sectors. This shift is a testament to the success of the Đổi Mới reforms, initiated in 1986, which opened the country to foreign investment and trade.

Key sectors driving Vietnam’s economic growth include manufacturing, particularly in electronics, textiles, and footwear. These industries have benefited significantly from the influx of **FDI Việt Nam** (Foreign Direct Investment in Vietnam), which has fueled technological upgrades and expanded production capacity. The service sector, encompassing tourism, finance, and logistics, is also experiencing robust growth, contributing significantly to **GDP Việt Nam** (Vietnam’s GDP).

Vietnam’s strengths lie in its strategic geographical location, a young and increasingly skilled workforce, and a stable political environment. The country’s proximity to major Asian economies, coupled with its membership in various trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), provides preferential access to key markets. This has made Vietnam an attractive destination for foreign investors seeking to diversify their supply chains.

However, Vietnam also faces several challenges. Infrastructure limitations, including inadequate transportation networks and energy shortages, can hinder economic growth. While significant progress has been made, further investment in infrastructure is crucial to support industrial expansion and facilitate trade. Another challenge is the need to improve the skills of the workforce to meet the demands of increasingly sophisticated industries. Investing in education and vocational training is essential to ensure that Vietnam can compete effectively in the global economy.

Furthermore, Vietnam’s economy is vulnerable to external shocks, such as fluctuations in global demand and commodity prices. The country’s reliance on exports makes it susceptible to downturns in major trading partners. Managing these risks requires diversifying export markets and promoting domestic demand.

Data and statistics paint a compelling picture of Vietnam’s economic performance. Over the past two decades, **Kinh tế Việt Nam** (Vietnam’s Economy) has consistently achieved high growth rates, making it one of the fastest-growing economies in Southeast Asia. This growth has been driven by a combination of factors, including increased investment, export expansion, and rising domestic consumption.

- Manufacturing: A key driver of economic growth, particularly in electronics and textiles.

- Services: Tourism, finance, and logistics are experiencing rapid expansion.

- Agriculture: Still a significant contributor, but its share of GDP is declining.

- FDI: Attracts significant foreign investment, fueling technological upgrades.

Recent trends indicate a continued shift towards higher value-added industries and a greater emphasis on innovation. The government is actively promoting the development of technology-intensive sectors, such as information technology and biotechnology, to enhance the country’s competitiveness.

In conclusion, Vietnam’s economic landscape is characterized by a dynamic mix of strengths and challenges. While the country has made remarkable progress in recent decades, continued investment in infrastructure, education, and innovation is crucial to ensure sustainable and inclusive growth. The nation’s ability to navigate these challenges will determine its future economic success.

The next chapter will delve into the specifics of “GDP Growth and its Drivers,” analyzing Vietnam’s GDP growth trajectory, identifying key factors contributing to its success, such as infrastructure development, technological advancements, and export-oriented industries, and discussing the impact of global economic trends on Vietnam’s GDP performance.

Chapter Title: GDP Growth and its Drivers

Following the overview of Vietnam’s economic landscape, understanding the drivers behind its impressive **GDP Việt Nam** growth is crucial. Vietnam has consistently demonstrated robust economic expansion, making it one of the fastest-growing economies in Southeast Asia. This chapter delves into the key factors contributing to this success, examining the interplay of infrastructure development, technological advancements, export-oriented industries, and the impact of global economic trends.

One of the primary drivers of Vietnam’s **GDP** growth is its significant investment in infrastructure. The Vietnamese government has prioritized infrastructure development, recognizing its vital role in facilitating economic activity and attracting investment. This includes improvements in transportation networks, such as highways, ports, and airports, as well as investments in energy and telecommunications infrastructure. These developments reduce transportation costs, improve supply chain efficiency, and enhance the overall business environment, thereby boosting economic output. The expansion of industrial parks and special economic zones also plays a critical role in attracting both domestic and foreign investment, further contributing to **GDP** growth.

Technological advancements have also played a crucial role. Vietnam has been actively promoting the adoption of new technologies across various sectors, including manufacturing, agriculture, and services. This includes investments in research and development, the promotion of innovation, and the development of a skilled workforce capable of utilizing advanced technologies. The growth of the IT sector, in particular, has been a significant contributor to **GDP**, with increasing exports of software and IT services. Furthermore, the adoption of automation and digital technologies in manufacturing has improved productivity and competitiveness, driving further economic growth.

Vietnam’s export-oriented industries are another key engine of **GDP** growth. The country has successfully positioned itself as a major exporter of goods, particularly in sectors such as textiles, electronics, and footwear. This success is driven by a combination of factors, including competitive labor costs, a favorable investment climate, and access to international markets through free trade agreements. The **Kinh tế Việt Nam** has benefited significantly from these exports, which generate substantial foreign exchange earnings and create employment opportunities. The government’s focus on export diversification and value-added manufacturing has further strengthened this sector’s contribution to **GDP**.

Global economic trends also exert a significant influence on Vietnam’s **GDP** performance. As a highly open economy, Vietnam is susceptible to fluctuations in global demand, commodity prices, and financial flows. Positive global economic conditions, such as strong growth in major trading partners, tend to boost Vietnam’s exports and attract **FDI Việt Nam**, leading to higher **GDP** growth. Conversely, economic downturns or trade tensions can negatively impact Vietnam’s economic performance. The country’s ability to navigate these global challenges and adapt to changing market conditions is crucial for sustaining its **GDP** growth trajectory. For example, during the recent global economic uncertainties, Vietnam demonstrated resilience by diversifying its export markets and focusing on domestic demand.

In conclusion, Vietnam’s **GDP** growth is driven by a combination of factors, including infrastructure development, technological advancements, export-oriented industries, and the impact of global economic trends. These factors are interconnected and mutually reinforcing, creating a virtuous cycle of economic growth. Understanding these drivers is essential for policymakers and investors alike, as they seek to capitalize on the opportunities presented by Vietnam’s dynamic economy. This sets the stage for a deeper examination of **FDI Việt Nam**, which will be explored in the next chapter, focusing on the opportunities and challenges associated with foreign direct investment in Vietnam.

Here’s the chapter on FDI in Vietnam, following all the specified guidelines:

FDI in Vietnam: Opportunities and Challenges

Building upon the previous chapter’s discussion of “GDP Growth and its Drivers,” where we analyzed Vietnam’s impressive GDP growth trajectory fueled by infrastructure development, technological advancements, and export-oriented industries, this chapter delves into a critical component of that success: Foreign Direct Investment (FDI). The influx of FDI has been instrumental in shaping *Kinh tế Việt Nam*, contributing significantly to its economic dynamism.

FDI has played a pivotal role in Vietnam’s economic development since the Đổi Mới reforms. It has not only provided much-needed capital but also facilitated technology transfer, improved management practices, and created employment opportunities. The impact of FDI extends beyond mere financial contributions; it has fostered integration into global value chains and enhanced the competitiveness of Vietnamese industries.

Several types of FDI flow into Vietnam, each with its own characteristics and impact:

- Greenfield Investments: These involve establishing new operations in Vietnam, such as factories or service centers. They create new jobs and contribute directly to increasing production capacity.

- Mergers and Acquisitions (M&A): This involves foreign companies acquiring existing Vietnamese businesses. M&A activity can inject capital and expertise into local firms, improving their efficiency and market access.

- Reinvested Earnings: Foreign companies operating in Vietnam often reinvest a portion of their profits back into their operations, further expanding their presence and contributing to economic growth.

Certain sectors have consistently attracted the most FDI. Manufacturing, particularly in electronics, textiles, and footwear, has been a major beneficiary. The availability of relatively low-cost labor and a strategic location within Southeast Asia have made Vietnam an attractive destination for manufacturers seeking to diversify their supply chains. Real estate and infrastructure development have also seen significant FDI inflows, driven by urbanization and growing demand for housing and commercial space. Furthermore, the service sector, including finance, retail, and tourism, is increasingly attracting foreign investment.

The Vietnamese government has actively promoted FDI through various policies aimed at creating a favorable investment climate. These include:

- Tax Incentives: Offering reduced corporate income tax rates and tax holidays to attract investment in priority sectors and regions.

- Streamlined Investment Procedures: Simplifying the process of obtaining investment licenses and approvals to reduce bureaucratic hurdles.

- Infrastructure Development: Investing in transportation, energy, and telecommunications infrastructure to improve connectivity and reduce logistics costs.

- Legal and Regulatory Reforms: Strengthening the legal framework to protect investor rights and ensure fair competition.

These policies have contributed significantly to making Vietnam a competitive destination for FDI, thereby boosting *GDP Việt Nam*.

Despite the numerous benefits, Vietnam also faces potential challenges and risks associated with FDI. One concern is the potential for over-reliance on foreign investment, which could make the economy vulnerable to external shocks. Another challenge is ensuring that FDI contributes to sustainable development and does not lead to environmental degradation or social inequality. Transfer pricing and tax avoidance by multinational corporations are also potential risks that need to be addressed through effective regulatory oversight. Furthermore, competition from other emerging economies seeking FDI poses a continuous challenge.

Another aspect is ensuring that *FDI Việt Nam* aligns with the country’s long-term development goals. This requires careful screening of investment projects to ensure they contribute to technology transfer, skills development, and the upgrading of local industries. It also involves promoting linkages between foreign-invested enterprises and domestic firms to foster knowledge sharing and create opportunities for local suppliers.

Looking ahead, Vietnam needs to continue refining its FDI policies to address these challenges and maximize the benefits of foreign investment. This includes strengthening regulatory capacity, promoting innovation and technology transfer, and ensuring that FDI contributes to inclusive and sustainable economic growth. The next chapter will explore the role of trade in Vietnam’s economic development.

Conclusions

Vietnam’s economy presents a dynamic and promising landscape for investment. Strong GDP growth, coupled with increasing FDI inflows, suggests sustained economic progress. However, understanding the specific challenges and opportunities is crucial for navigating this complex market. Further research and analysis are recommended for those seeking to capitalize on Vietnam’s economic potential.